An interview with Ivan Glucina, an international freight specialist from the Expense Reduction Analysts – Asia Pacific team.

Ivan has over 25 years of sales and general management experience in all facets of the freight industry. He has enjoyed a variety of leadership roles and has managed some of the largest international freight forwarding companies in Australia and New Zealand.

Prior to joining Expense Reduction Analysts, Ivan was the General Manager for Toll Global Forwarding, and previously held General Manager and Managing Director roles for Kuehne + Nagel, CEVA Logistics and TNT Express Worldwide.

Throughout his career, Ivan has established a strong record of sales growth, process improvement and effective cost management including leading complex implementations for some of the most advanced supply chain management solutions available.

Ivan, what would you say is the hottest news in the international freight market right now?

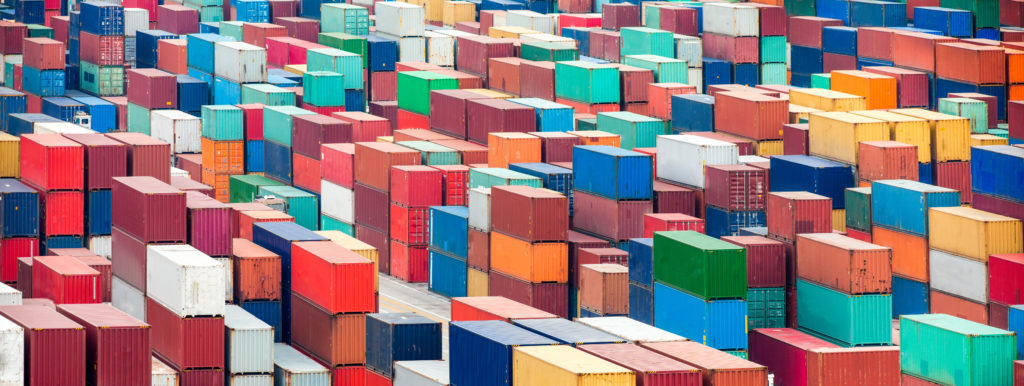

There are two notable modes of international freight; ocean and air freight.

Ocean freight: Carriers (shipping lines) have struggled to remain profitable over recent years due to a weak global economy, with a recent low point being the Hanjin Shipping bankruptcy in 2016.

This resulted in downward pressure on rates. In 2017, operating margins for most carriers improved following numerous mergers, improved demand and higher rate levels.

The top three carriers in 2000 controlled 24% of global shipping; in 2017, more than 40% is controlled by the top three.

This means that carriers will work more closely together to maintain or lift rates wherever possible.

Air freight: It’s not commonly understood that almost half of airfreight cargo is carried on commercial passenger flights globally.

Passenger demand for air travel has been showing strong growth year upon year, driving airlines to increase flights and capacity. Air cargo capacity has therefore continuously been growing with more aircraft and more flights.

At the same time, many airlines’ ageing Boeing 747s are being sold to cargo carriers in higher numbers, further increasing their capacity.

Although airfreight rates have been relatively stable for some time—dependent upon sector—there is still competition in this mode.

What would you say are the most significant risks for the managers of international freight?

There are a multitude of hidden costs and contributing factors in the international freight industry which make managing this cost extremely difficult for anyone who is not an expert in the field. For example:

- There are often unnecessary fee charges, and the client shouldn’t be paying them.

- Some freight forwarders add high margins which can be negotiated.

- Foreign exchange rate fluctuations affect the overall cost of freight, and margins are placed on top of these rates.

- Fuel charges also affect the cost of freight, and while there is no control over international fuel costs, these rates need to be monitored and managed. Air freight can be significantly influenced by fuel costs.

- There is great variance regarding trade, and it can be difficult to get transparency on what is being charged.

- Freight forwarders are not obliged to be transparent in their fees; only specific Government charges must be free from margins.

Should companies be using freight forwarder?

Definitely! For air freight, it’s required, and shipping lines will typically only deal directly with huge ocean freight volumes and specific commodities. Clients need to be aware that the base cost of freight services can vary significantly between freight forwarders. With higher volumes of freight, some freight forwarders can lower their base pricing through more effective cargo consolidation.

Clients should also be careful with the use of the additional services of a “freight broker” as well as those of a freight forwarder as it adds an extra margin of cost to the process.

How can freight buyers manage their costs?

By engaging in the Expense Reduction Analysts of course! It may be beneficial to fix rates for extended periods, by utilising the services of a freight forwarder that is best suited to their unique service requirements. There are many smart technologies and service solutions available to clients that may provide, such as:

- Reduced transit times and reduced costs: direct-to-store models, DC bypass, origin VAS, and air-sea hybrid.

- Improved information: document management, shipment visibility, and purchase order visibility.

Where are the opportunities for savings?

It is challenging to get savings unless you have a freight expert on board. Due to the complexity and number of various charges, it’s hard to know which costs are real—and realistic! The best solution is to use a specialist such as myself, to manage and monitor a freight tender.

Expense Reduction Analysts have recently worked with two large clients in WA and achieved savings more than 40% on their international freight costs. While this is higher than we would normally expect, there are significant savings achievable in these high-cost areas.

About Expense Reduction Analysts

We help clients to support the health and growth of their business, whatever its nature, focusing on proactive expense and supplier management. As an Australian and global company, Expense Reduction Analysts can benchmark costs and spending, follow the latest supplier innovations, and have real-time data on changes and advancements. This strength gives Expense Reduction Analysts the recognition and power needed on supplier markets to best serve your interests.

For more information please contact Ruth Cohen at rcohen@expensereduction.com