The answer is more than likely yes, and here’s why:

The issue is often passed over or put in the too-hard basket when it comes to tail spend. Going over every expense in detail feels too difficult or time-consuming. You may not have the resources or time or feel it’s not a strategic move. These are some of the reasons or excuses I hear from CFOs and Finance Directors, although most acknowledge that it is an area with potential for savings. They tell me they should do something about it, but they’re busy. This is a source of frustration for me because they are working so hard to make money when a quick sanity check could add thousands to business profits without the need to work overtime.

This is part one of a two-part series where I explain what tail spend is and how it can be analysed and minimised without wasting hours of your team’s time.

What is tail spend?

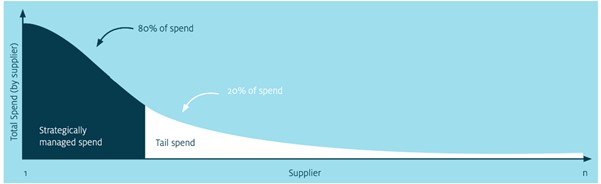

Tail spend defined differently in every organisation, but the most common definition is to use the 80/20 rule (Pareto Rule), as shown in Diagram 1.

The term refers to the bottom 20% of the spend generally supplied by 80% of suppliers. Tail spending is usually considered low-value purchasing as it makes up only a tiny portion (20%) of total cost spend. In most companies, it could be called ‘unregulated spend’ or ‘non-strategic’ spending.

Tail spend also known as ‘maverick’ or ‘rogue’ spend. And it does cause trouble!

Diagram 1. Tail spend. Source: Expense Reduction Analysts

Thousands of operating consumables and SKUs can fall into the tail spend category, including PPE, packaging, shipping and warehouse supplies, janitorial and sanitation supplies, industrial gases and office supplies. The list is endless. It can be quite a considerable and daunting list. The expenses they create are minimal on their own but let me tell you: they add up!

Generally, there is little understanding within an organisation of how much money is involved in tail spending and even less knowledge on managing it effectively. This often leads to companies overlooking thousands and, in some cases, hundreds of thousands of dollars each year. It’s money they are unwittingly and unnecessary paying to suppliers when it could be put to better use.

The challenge with tail spend is twofold; first, you must identify which categories are blowing out in terms of costs. Next, you have to figure out how to claw back the savings.

How much money are you missing out on?

While tail spend is considered small in relation to total costs, it is also one where considerable savings may be made. This money can go straight to the bottom line or be used to fund a new project or headcount.

After many years working in cost-reduction, I have noticed that savings from tail spend management can be in the range of 10% – 15% in the first year. However, my experience has shown that specific individual categories can deliver up to 40% savings when managed well.

These potential savings are often overlooked as an in-house source of funds due to a low expectation of return, lack of visibility, a lack of internal resources and the lack of adequate benchmark data.

If you have a tail spend of $1 million, a 10% savings is $100,000. Imagine recovering this money in months without cancelling supplier contracts or letting people go. It’s a pretty good feeling.

Back-office efficiency is the other outcome of a tail spend assessment and action taken to address any problems. As a result of the process, you end up with a smoother accounts process and less confusion, which can save time and resources.

Reviewing your tail spend: where to start?

The thought of taking on tail spend can be daunting, and often companies don’t have the resources to wade into tens of thousands of transactions that are usually not in the correct format for easy analysis.

You have to start somewhere and keep in mind that there are third parties that can help you through this or even do it for you.

The first step is finding and identifying your company’s tail spend. This will likely differ from company to company, so it’s a worthwhile process. As mentioned earlier, the Pareto rule is the simplest way to define it.

Once everyone is clear about tail spend, it is a case of getting hold of the data for analysis. When I help clients, they often hand me a stack of pdf documents or invoices, which I then convert into digital format.

Once the data is in a proper state for analysis and has been standardised and cleaned, the analysis will uncover where the spend is and who the suppliers are. There is also software that makes this process easier and quicker so you can pinpoint ways to save in a short period of time.

At the end of the day, we want to understand the “who and the what” that makes up your tail spend. Then we can do something about it.

Once we know where the overspending is happening and who is behind it (it could be an error in pricing or because someone is spending without the authority to do so), we help figure out what to do about it.

Some software tools such as ERAs SpendVueTM will provide top-line executives in-depth intelligence on their organisation’s spending, including tail spend. With the help of this tool, certified analysts drill deep into financial data and apply ERA’s proprietary industry benchmarks to identify spending anomalies. The result is a set of clear, immediate, and actionable insights available in an easy-to-understand format. Your advisor will then work with you to identify a pathway to cash flow improvement that best suits your organisation’s needs. You can view a short video of SpendVueTM at the following link https://vimeo.com/680583659 .

In Part 2 of this series, we’ll go into what you can do with your tail spend once you have a deeper understanding of what it consists of.

If you want to know more about managing your tail spend, please get in touch with Grant Morrow.

Grant Morrow is a Principal Consultant at Expense Reduction Analysts and is a SpendVue certified advisor. He brings over 30 years of hands-on experience working with SME companies to identify where they are overspending and develop strategies for better cost management.